People always ask how to Process employee expenses in Oracle fusion ?

How it works? What is the flow for employee expense to reimbursement?

Simple process flow is Enter>Approve>Audit>Reimburse

Check the complete Video Tutorial here for Process Employee Expenses

Let us discuss with a Scenario

Employee of Tata Motor works in India Location with India Business Unit. He is travelling to USA and incurred several travel related expense. While starting the travel he asked for some advance cash from company in USD Currency. Usually most f the Companies issues Corporate Credit card to employee to spent for travel related expenditures like Hotel Accommodation ,Taxi fare and meals etc.

So once the travel completes, employee submits the claim for Process Employee Expenses in oracle expenses portal for reimbursement. Whatever advance already taken will adjusted from he total expenses amount.

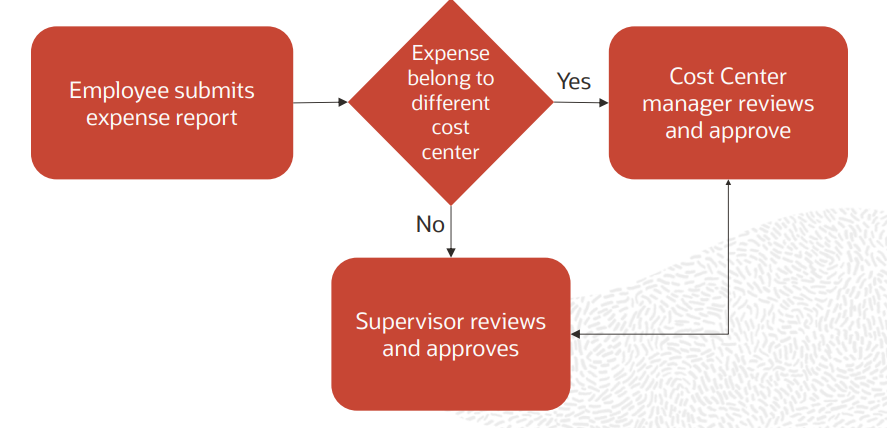

Expense can be belongs to different cist center. Oracle has the functionality book the expenses to the specific cost center and respective cost center manager need to approve the expenses for reimbursement.

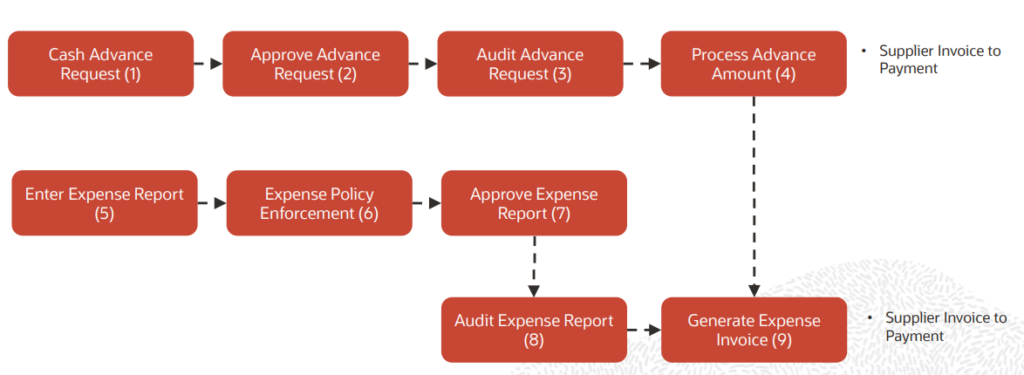

Let us see the flow below how it works in Oracle Cloud ERP

1.Cash Advance request raises by Employee

Employee need to raise a cash advance request .Employee also need to mention in which currency advance is required .

2.Approve the Advance request

BPM approval process can be configures to define any specific rules for advance approval.The seeded BPM approval task is-– FinExmWorkflowCashAdvanceApproval

You can use a Supervisory list builders for this so that your supervisor can approve the request

3.Audit advance request

Audit is a optional step. You can implement Audit as per your organisaction authorization policy.if your expenes go to auditor once he approve he specifies a date by which the cash advance must be applied to the employee,s expenes report for adjustment

It will automatically applies the cash advance to the apprved expenes report on and after due date

4.Process Advance amount-Process Employee Expenses

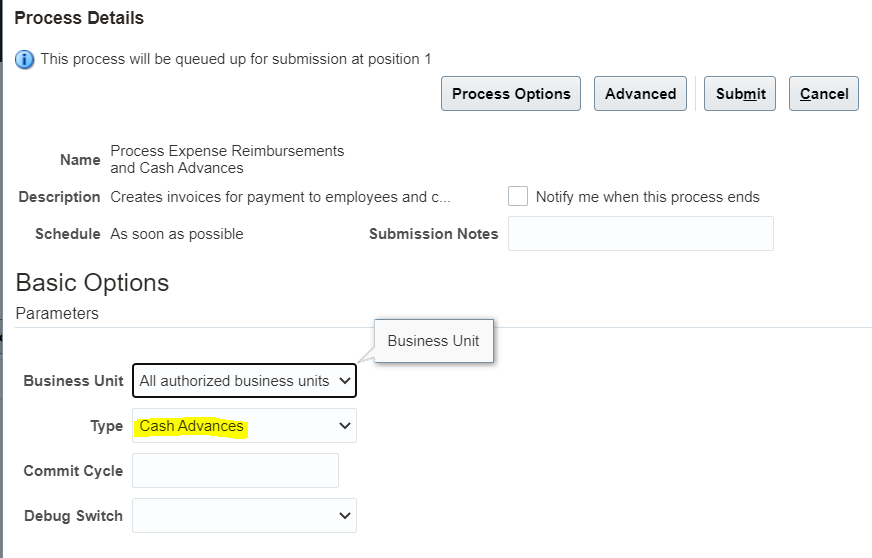

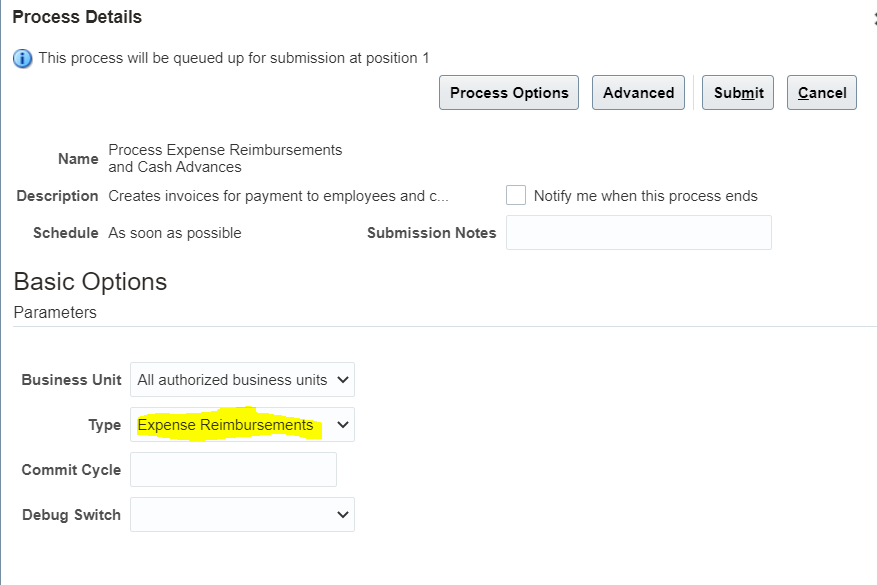

Run the program -– Process Expense Reimbursements and Cash Advances

from Tool>Scheduled process

Select the Type- as Cash Advance

Process the Payment Request and make payment in order for the advance to be available for adjustment

Here the Accounitng entry is

Cash Advance Clearing A/c 400 Dr

To Liability A/c 400 Cr

5.Enter Expense Report

Enter the expense report .

Yes you can enter the related actual travel expense during the travel or after completion of travel. As per Expenses policy of your organization you have to enter them with in specific time period. Otherwise these expense will be deducted from your salary

You can enter the expenses in multiple way like: Oracle Simplifies Expenses Entry UI

Mobile apps, Spreadsheet, Recurring expense and third party tool.

You can configure your expenses report template to be used for your report submission.

Click here to watch how to create expense report template

You can define your conversion rate for foreign currency transaction

You can attach tax code to expenes line and amount will be tax inclusive

Employee can overwrite Expenses distibution account while entering expenses with special access

You can assign Project details if expenes is related to specific project -like Project number,Project organization,expenditure type and Task

6.Inforcement of Expense Policy

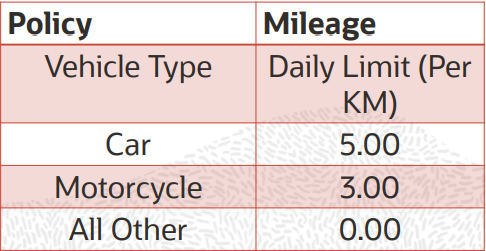

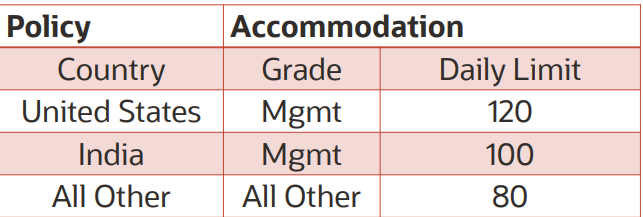

Policy will be enforced as per your expense policy and receipt management.Configure Oracle expenes for’

Policy by Expense Category

Expense Report Receipt Rule

Example

7.Approval of Expense Report(Process Employee Expenses)

Approval Task – FinExmWorkflowExpenseApproval

You can Mapp in HRMS the cost center manager to respective cost center

8.Expense Report Audit (Optional Setup)

Perform the below setup for expenses Audit

1.Expense Report Audit Selection Rules

2.Expense Report Audit Rule by Expense Template and Type

3.Expense Audit List Membership

9.Generate Expense Invoice

Schedule the Job “Process Expense Reimbursements and Cash Advances”

Here select the type as- Expense Reimbursement

Process the Payment Request and make payment in order for the advance to be available for adjustment

Accounting entry will be

Expense (Respective) A/c 1000 Dr

To Cash Advance Clearing A/c 400 Cr

To Liability A/c 600 Cr

Here advance amount is adjusted against the expenses amount( See the accounting entry in step no 4)