To create Automatic receipt, Lockbox process is one of the ways to achieve this requirement.

File Received by Bank => Upload the files => System will read the file => Receipt will be

created => Receipt will be applied.

Bank => Send File => All Deposit details/information is called Lockbox file.

Process needs to be run to read the lockbox file.Additional information = Remittance Details.

We can achieve the automatic apply also through some setups.Receipt will be created through lockbox and if there is some additional information in lockbox like remittance reference, PO etc, through these details we can apply this receipts to the transactions.

Watch here-how to Process late charge in Oracle Fusion AR

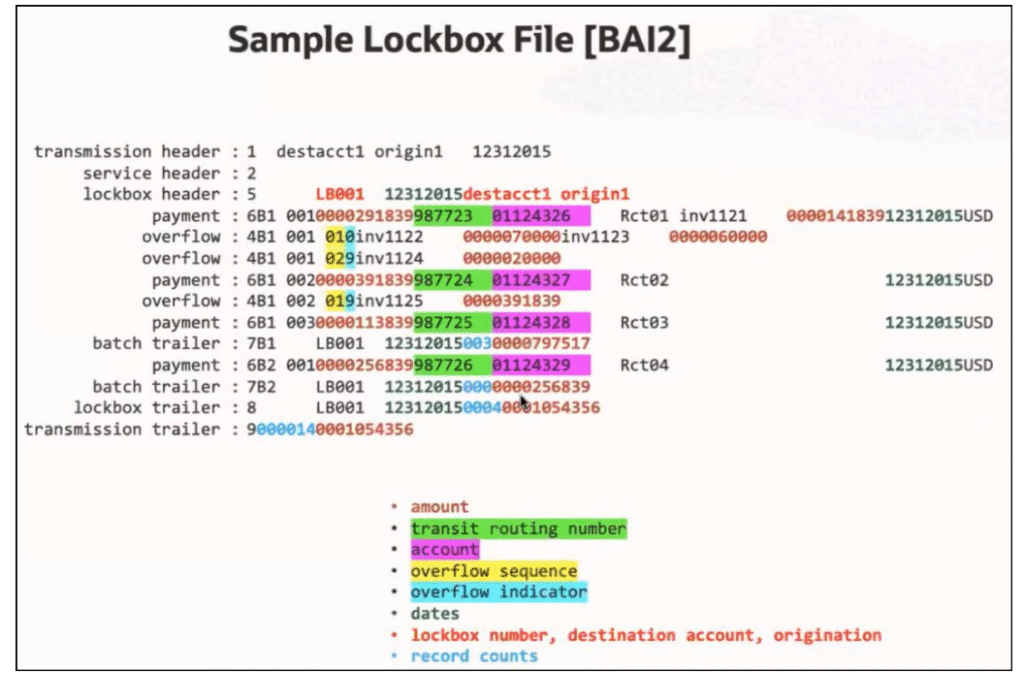

Sample LOCKBOX File-Lockbox Process

Oracle Fusion AR – Lockbox process Flow

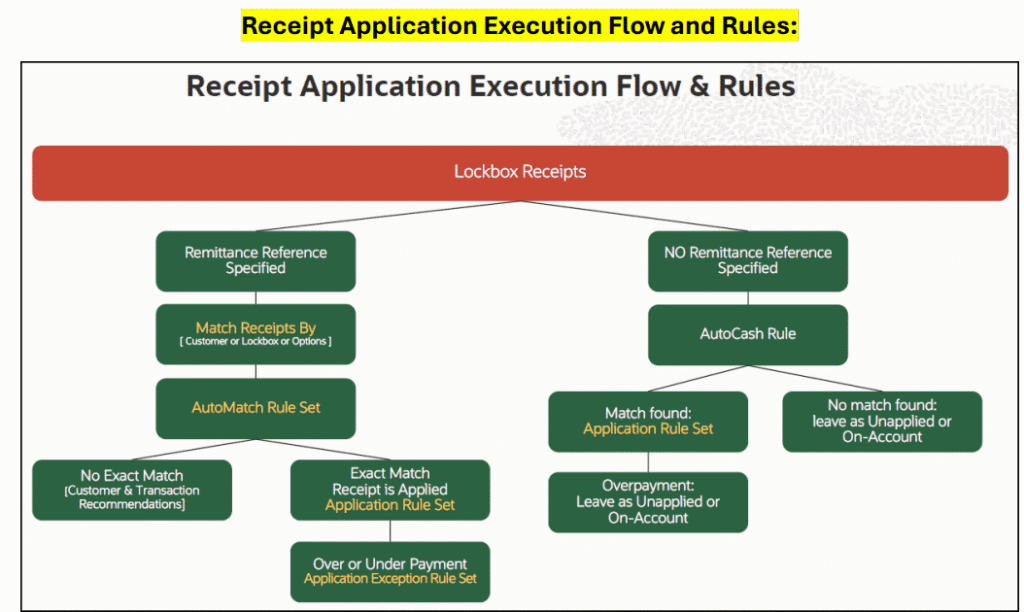

There are two ways to execute the Lockbox receipt application.

- Remittance details are specified.

- Remittance details are not specified.

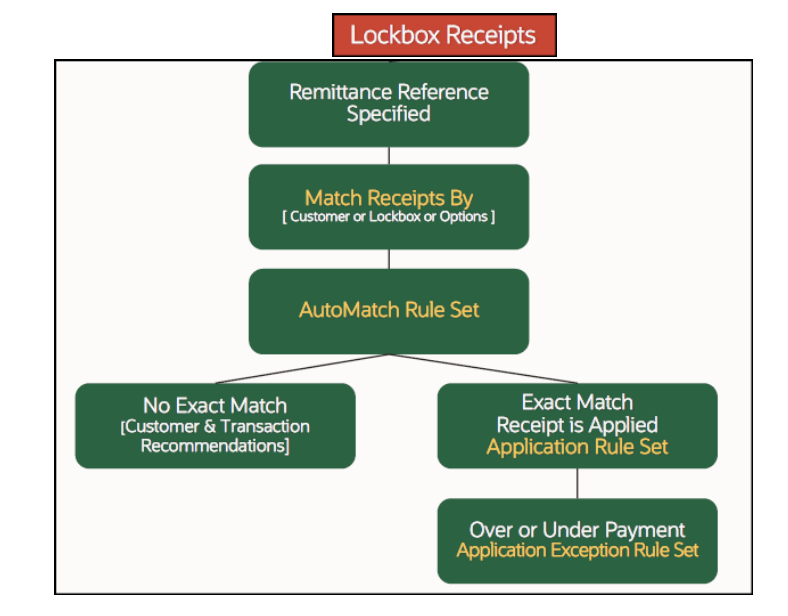

Scenario 1: Remittance details are specified

First it will check what remittance reference is specified.

Q => How system would know that what information customer provides?

A => It will derive from Customer Account Level. (Receipt Matching).

Match Receipt By:

Check here for Oracle cloud server Access for Practice

AutoMatch Rule Set:-Lockbox Process

As per the AutoMatch Rule set, once receipt is created system will apply the receipt to the

transaction.If it does not exact match then system will recommend the transaction as per rule set.

If it is exact match, then it will invoke the Application Rule Set.

What is Application Rule?(Lockbox Process)

Application Rule will decide how the receipt applies to invoice lines.Invoice may have item lines, freight lines and tax lines. How the amount to be distributed to those lines. If it is full payment, then no problem.

But, if it is partial payment, the how payment to be distributed that we need to define in application rule set.

Over and Under Payment:

Over:

What if amount is left on receipt, after applying full amount to transaction.Should we Refund it, write off or keep it on account, or unapplied we have four options.That we can set under Application Exception Rule Set.

Under:

If it is under payment, we can adjust the invoices to close it.If it is over payment, then what needs to be done in Receipt and If it is under payment, then what needs to be done in Invoice/Transaction?That we can setup in Application Exception Rule Set.

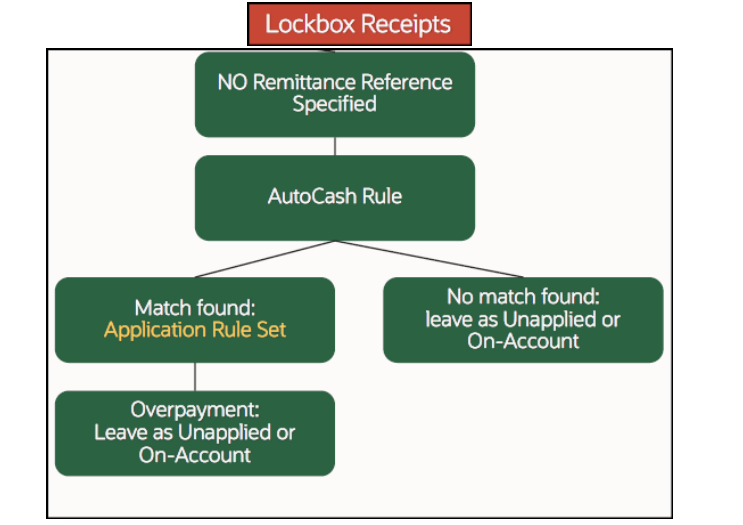

Scenario 2: Remittance details are not specified

There are two options to process the receipts if remittance are not specified:

- Keep the receipts as it is, and we can apply it manually.

- To auto apply, we can achieve this through “AutoCash Rule”.

There are 7-8 ways to match receipts:

a. Check if the transaction is available with exact amounts.

b. (Combo Rule) see if there are two invoices which total matches to receipt amount.

c. Try with oldest invoice.

d. Try with all the open invoices with receipt amount.

If the match found, it will invoke the Application Rule Set and the same process for

“Overpayment”.

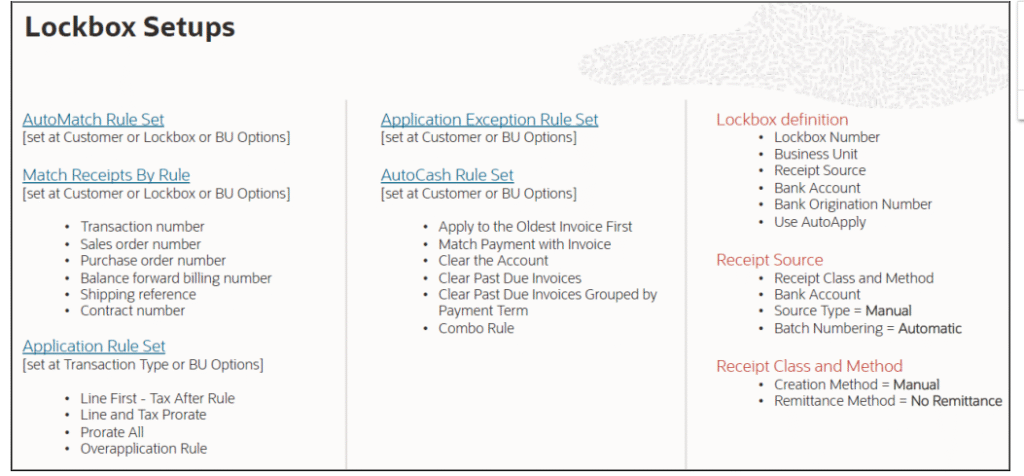

Setups:

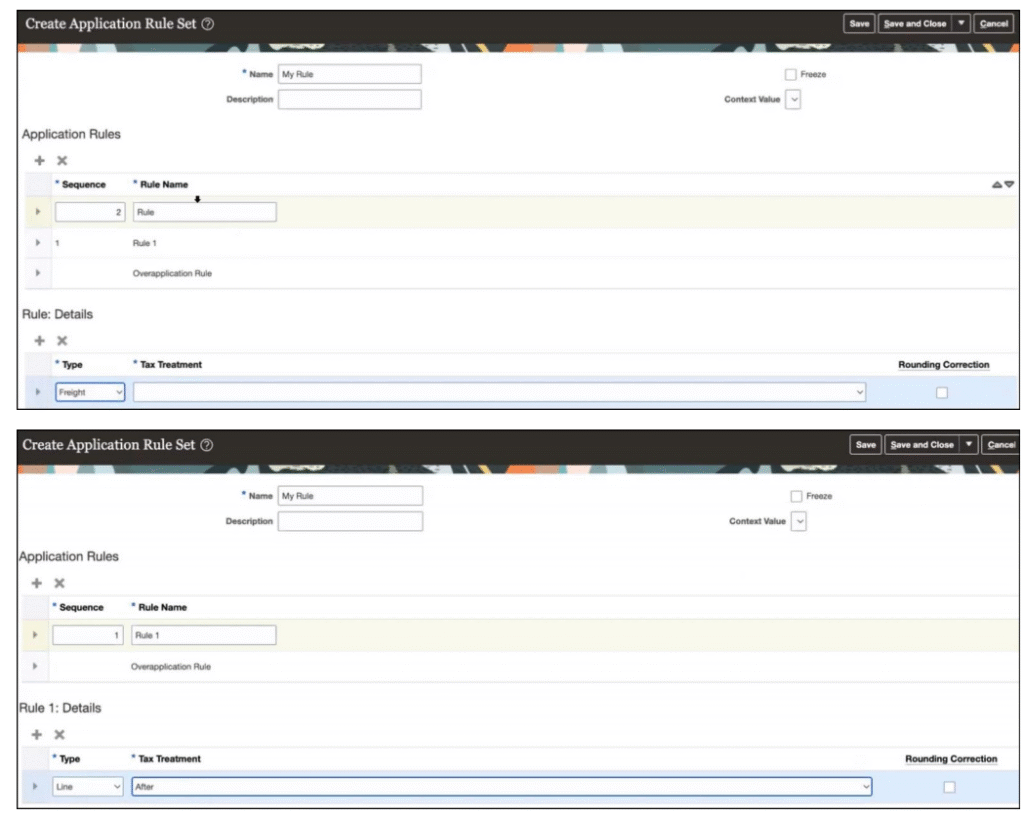

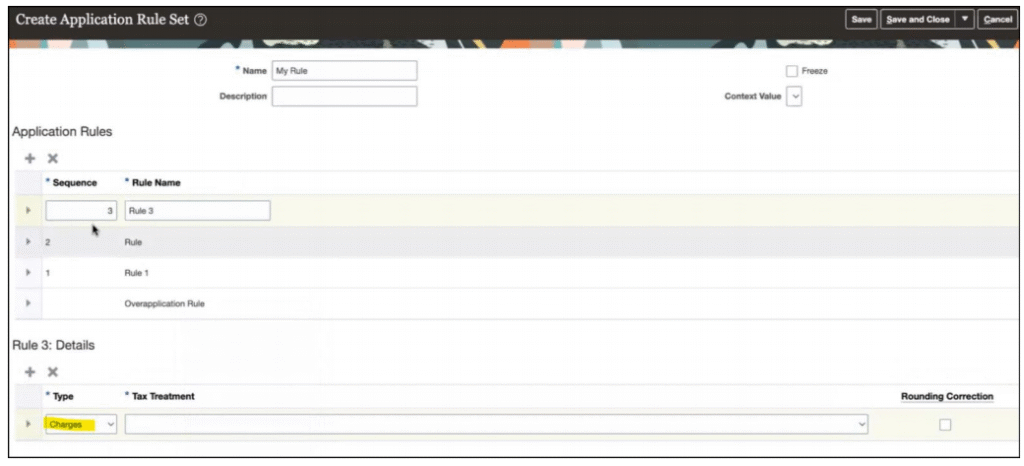

Manage Application Rule Set:

Rule:

Sequence 1: Apply amount to line first then Taxes.

Sequence 2: If still amount is remaining, apply to Freight.

Sequence 3: If still amount is remaining, apply to late charges

If you want to proportionately be distributed to all the lines:

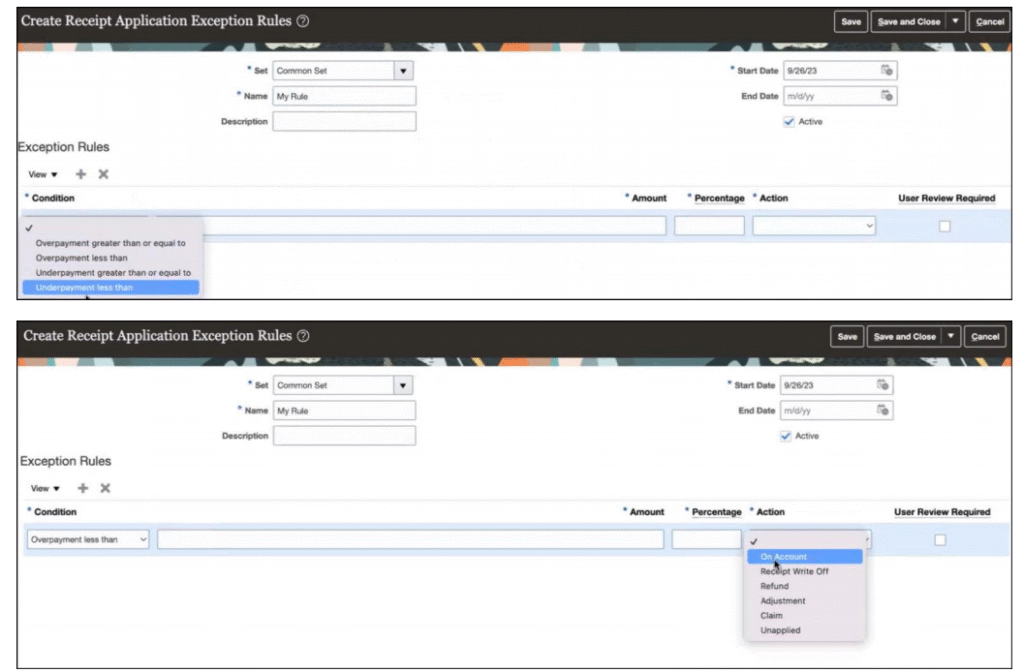

Manage Receipt Application Exception Rule:

It will come into the picture in case of over payment or under payment.

In case of over payment: On Account, Receipt Write Off, Refund and Unapplied.

In case of under payment: Adjustment (Invoice bring it down to close) and Claim.

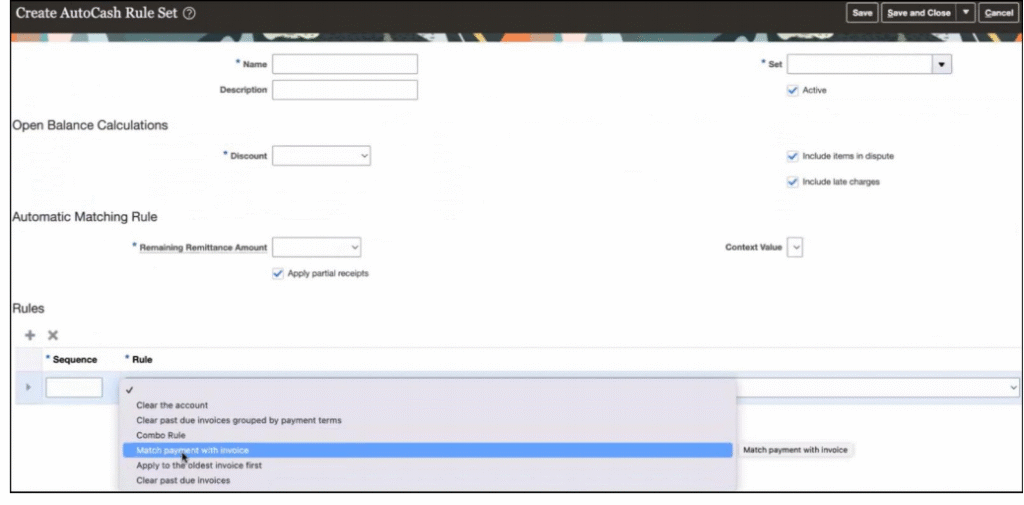

Manage AutoCash Rule Set:

It will come into the picture if no remittance details are specified.

We have 6 options to set rule. Mostly, we use “Match Payment with invoice”.

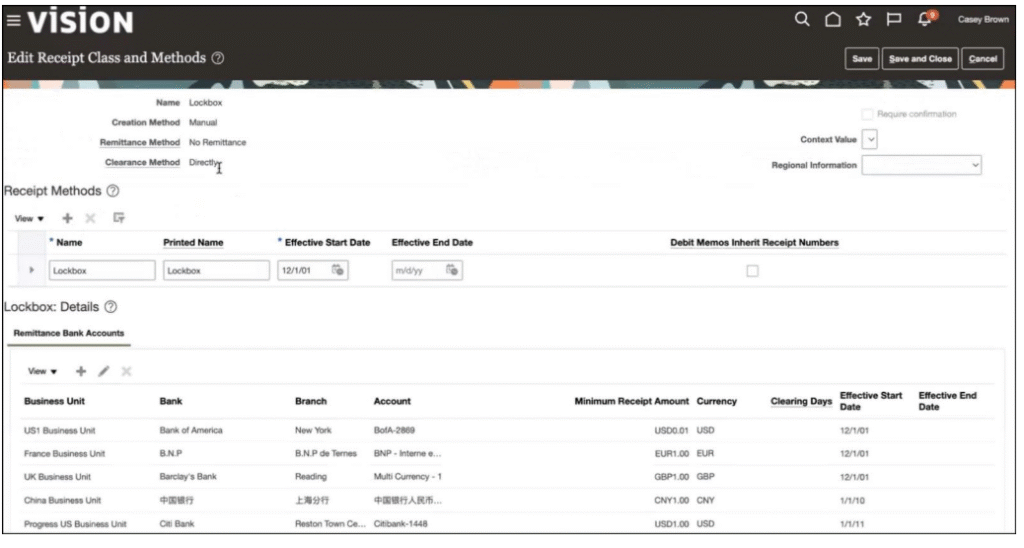

Manage Receipt Class and Method:

For Lockbox receipts, we have to create separate setup for Receipt class and method.

Note:

Creation Method: Always Manual

Require Confirmation comes into picture in case of automatic receipts.

Remittance Method: Always No Remittance (Remittance is instructing to bank to do

something like transfer, cash, check etc). Here, deposit is already happened.

Clearance: Directly

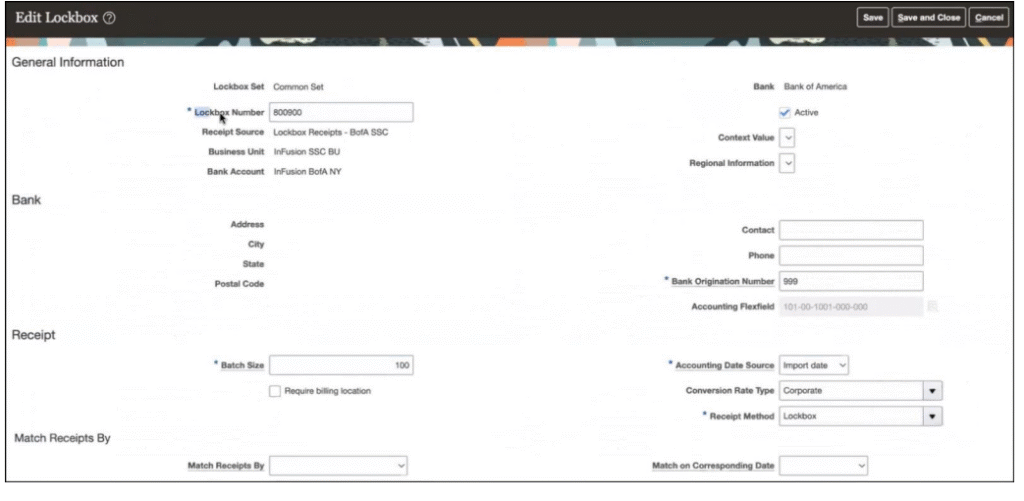

Manage Lockbox:

Note:

Lockbox Number: Need to get it from Bank. (you will see this number in the file as well).

(Bank identify the business by this number).

Bank Origination Number: this number also we get from the bank.

Batch Size: number of receipts.

Receipt Method: Attach which we created.

Match Receipt by: Here also we can select the option.

Use Auto Apply: This is an optional.

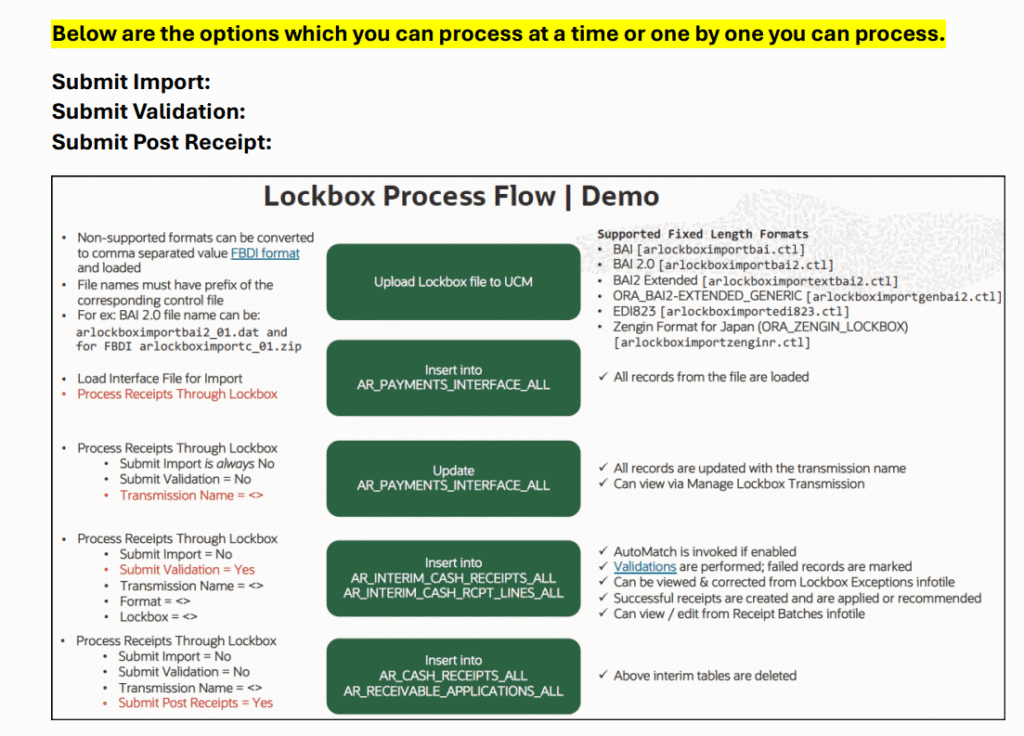

How to load the file:

Supported Fixed Length Formats

- BAI [arlockboximportbai.ctl]

- BAI 2.0 [arlockboximportbai2.ctl]

- BAI2 Extended [arlockboximportextbai2.ctl]

- ORA_BAI2-EXTENDED_GENERIC [arlockboximportgenbai2.ctl]

- EDI823 [arlockboximportedi823.ctl]

- Zengin Format for Japan (ORA_ZENGIN_LOCKBOX) [arlockboximportzenginr.ctl]

**What if the bank is not providing the file in above formats.

In this case, we can use FBDI format.

Name of the file is very important.

**Non-supported formats

can be converted to comma separated value FBDI format and loaded - File names must have prefix of the corresponding control file

- For ex: BAI 2.0 file name can be: arlockboximportbai2_01.dat and for FBDI

arlockboximportc_01.zip

Steps:

Once we get file from Bank => Upload it into UCM folder.

Process: Load Interface File for Import => Process Receipts Through Lockbox

(File will be placed at interface table).

Run the next process: Process Receipts Through Lockbox

Submit Import is always “NO”.

New Transmission: Yes

Submit Validation: YES/NO

Submit Post Receipt:

Author-Swapnil Marade