Oracle Fusion Tax is a part of the Oracle Financials Cloud suite that enables centralized tax configuration, determination, and calculation. For businesses operating in India, setting up GST correctly is vital due to the multi-tiered nature of taxes like CGST, SGST, IGST, and UTGST. The Regime to Rate Flow is the backbone of tax setup in Oracle Fusion and plays a crucial role in determining how taxes are applied on transactions.

n Oracle Fusion (specifically Oracle Fusion Tax), a “Regime to Rate Flow” is a key setup component that defines how taxes are applied to transactions, such as sales or purchases. It essentially links the tax regime (the broad legal framework for taxes) to the tax rates that apply within that regime, through tax rules and jurisdictions.

To set up or understand the Regime to Rate Flow for India GST (Goods and Services Tax) in Oracle Fusion, here’s an overview:

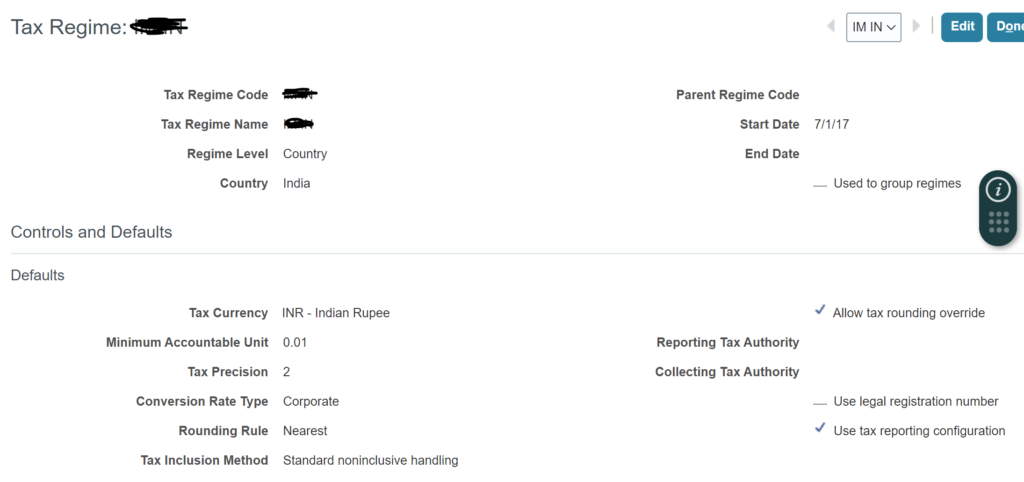

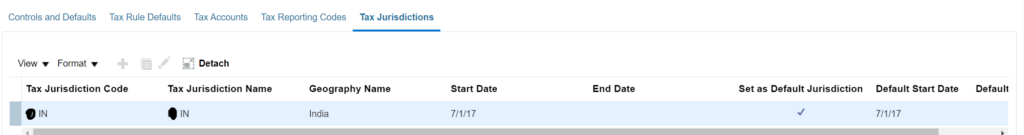

Create Tax Regime

Tax Regime

- Example:

IN GST(India Goods and Services Tax) - Defines the overall tax system applicable in a country or region.

- For India, it would cover CGST, SGST, IGST, and UTGST.

Watch here Tax regime setup in Oracle Fusion

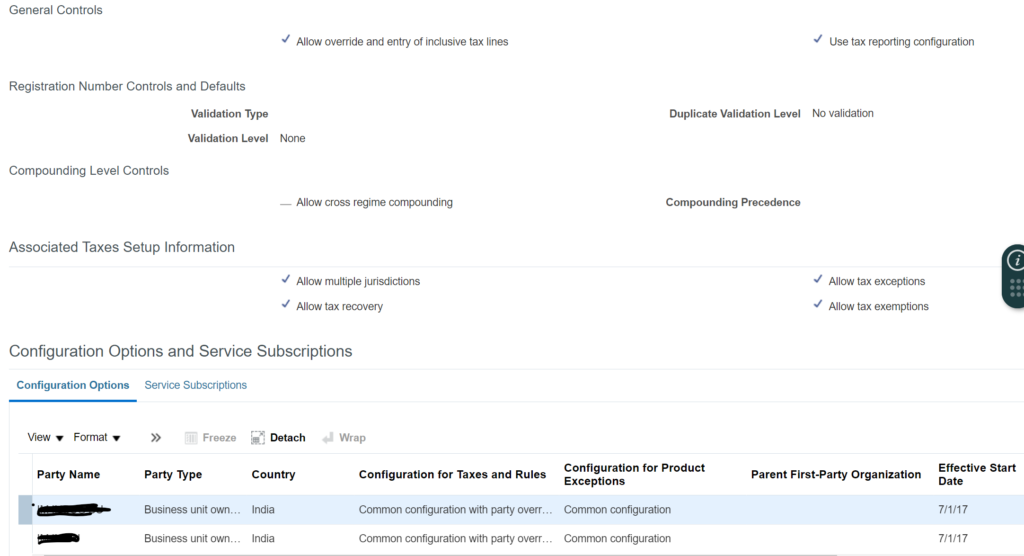

Assign the Business Unit to the Tax regime

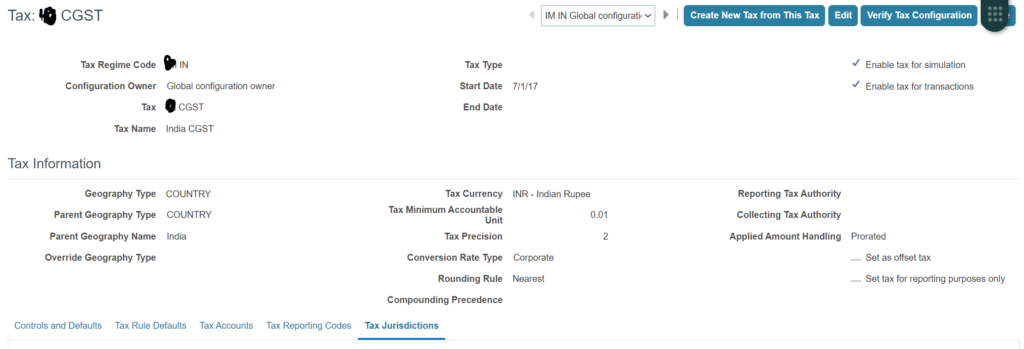

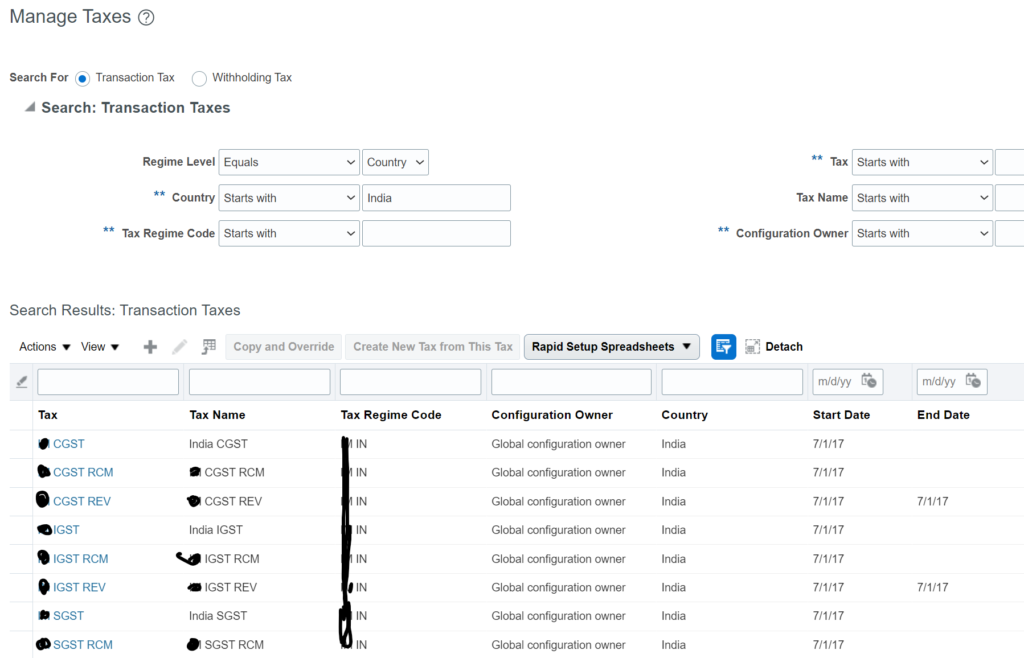

Create Tax Setup

Each type of GST is a separate tax:

- IGST (Interstate)

- CGST + SGST (Intrastate)

- UTGST (Union Territories)

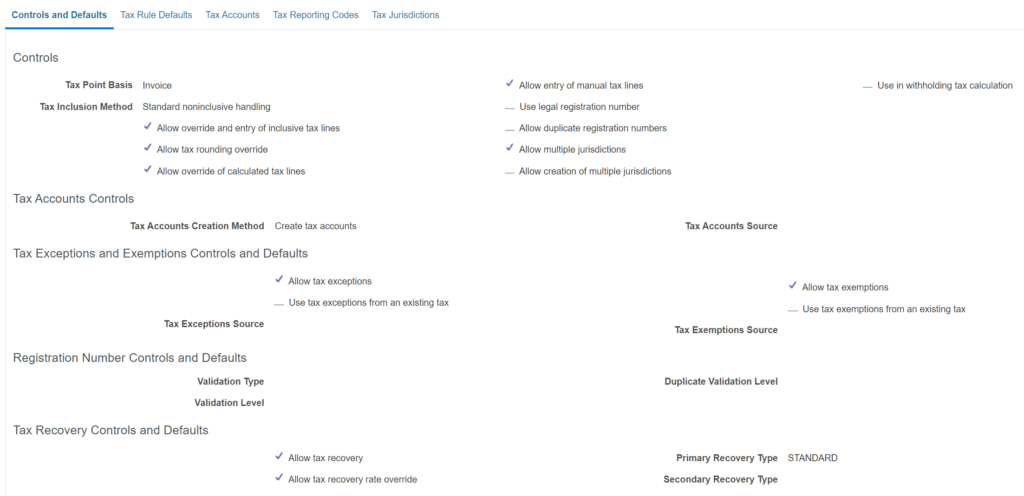

Define the Tax Control and default

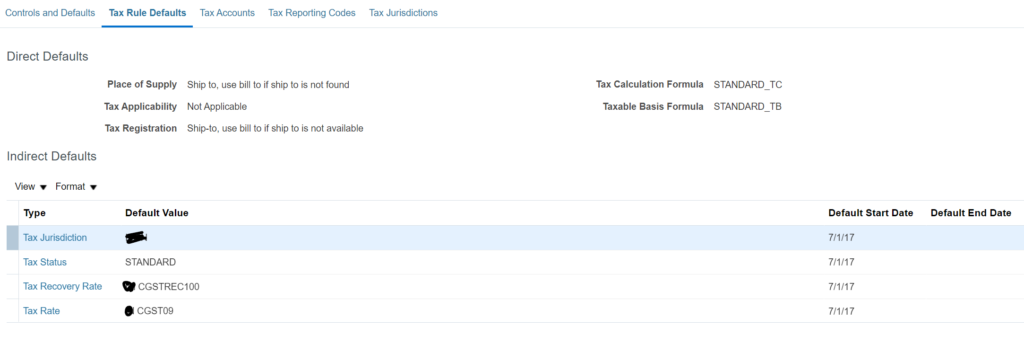

Define Tax Rule default

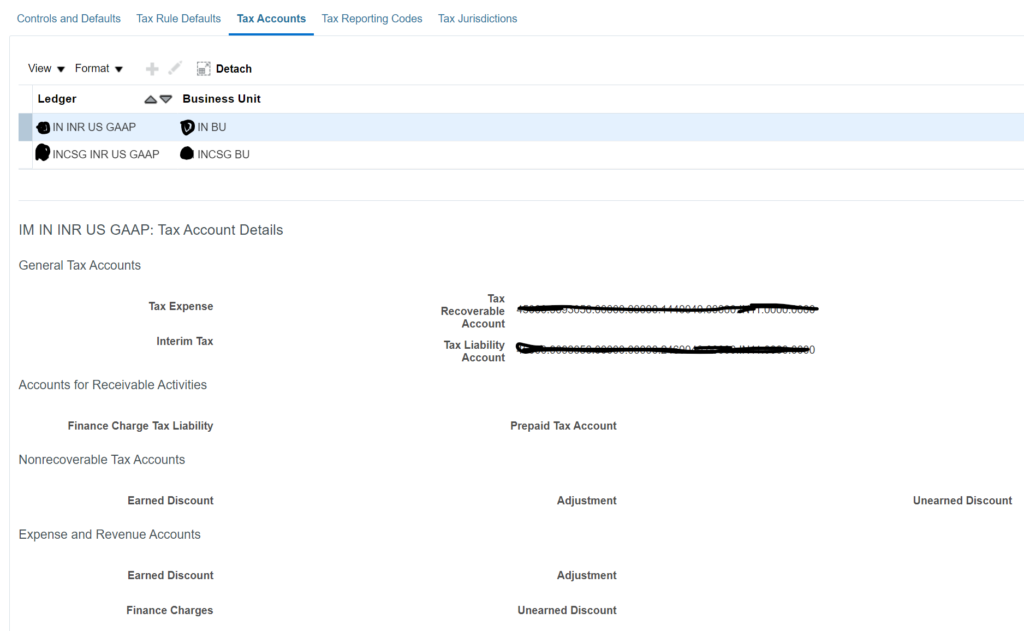

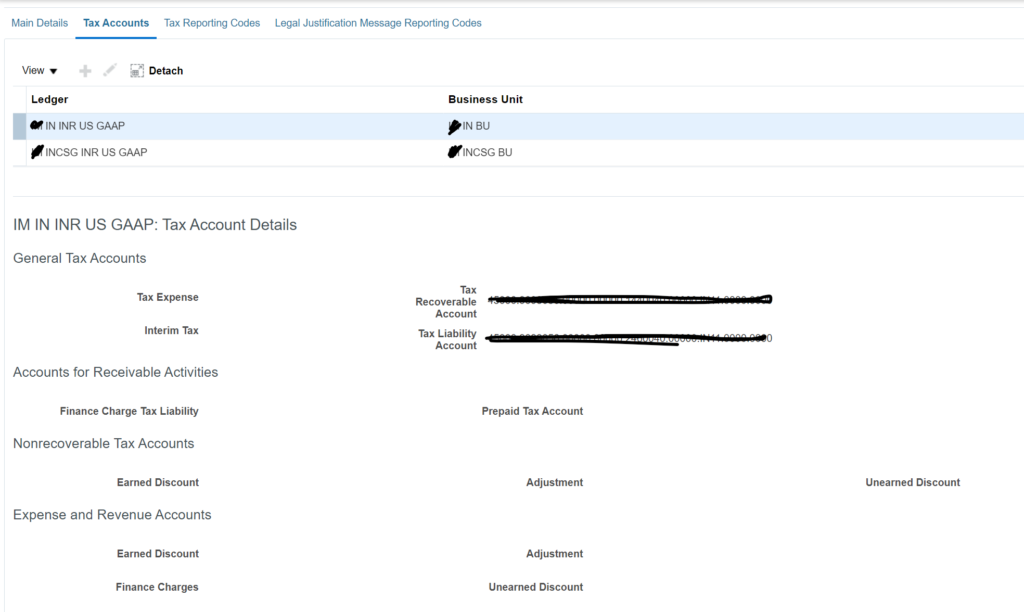

Assign Ledger Business Unit and Tax account

Tax Accounts Setup

For proper accounting entries:

- Go to:

Manage Tax Accounts - Assign Tax Recovery, Liability, Expense, and Receivable accounts to each tax.

This ensures journal entries are booked correctly in Payables/Receivables modules.

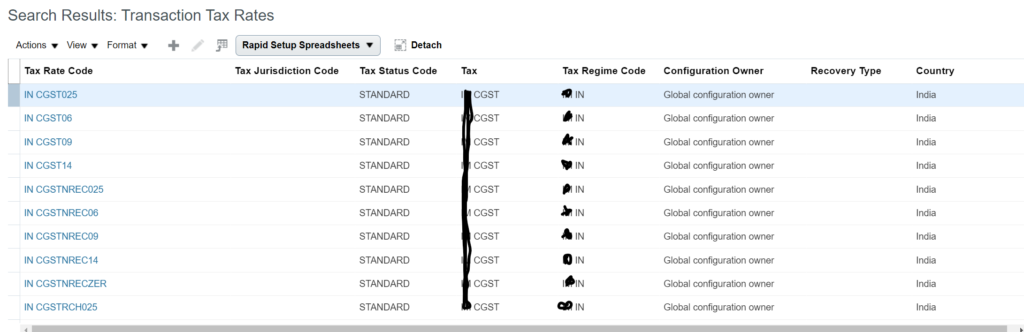

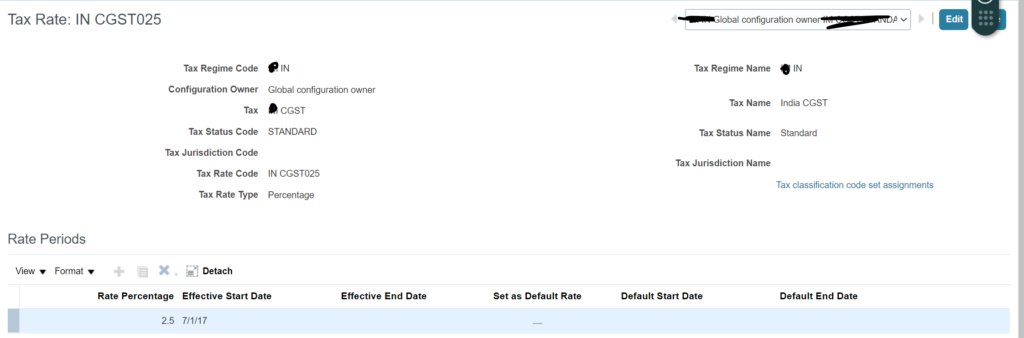

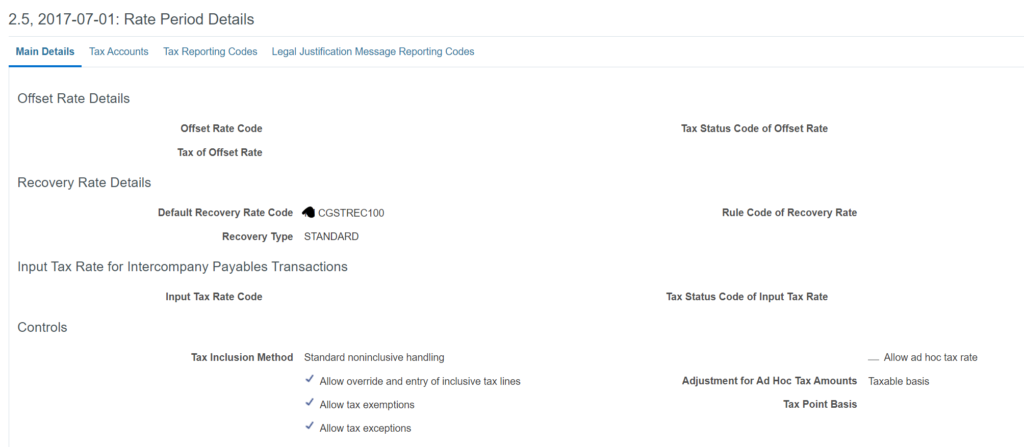

Create Tax Rate

. Tax Rate

- The percentage applied on taxable transactions.

- E.g., 5%, 12%, 18%, 28%

Best Practices

- Keep tax rates and rules updated with latest government notifications.

- Use effective dates to maintain historical rates.

- Leverage Global Tax Content Service (if available) for automated updates.

- Use Tax Simulator Tool in Oracle for testing scenarios.

To derive tax calculation of different rates we need to define tax rules for various tax rates and applicability

That we will discuss in Part 2

check here how to create tax formual in Oracle Fusion