External transactions and bank transfer

External cash transactions are transactions related to cash activity that haven’t been recorded in the applications. The sources of external transactions are:

- Manual Entry

- Import

- Balancing Transactions: Transactions created during reconciliation to record amount differences between the statement line and application transaction can occur due to bank fees, conversion rates, or other charges.

For Oracle fusion practice demo instance please check here

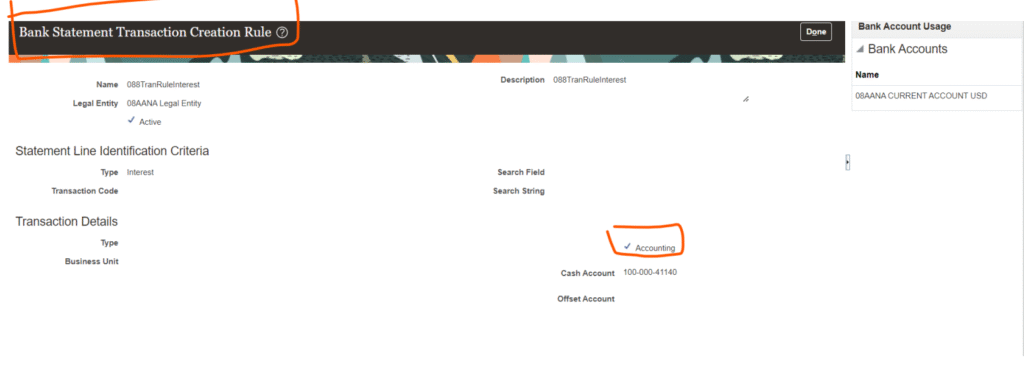

How to Create / inactivate a Bank Statement Transaction Creation Rule ?

Go to Manage Bank Statement Transaction Creation Rule

Watch here what is external transactions in oracle fusion cash management (Certification question)

Note-https://youtu.be/zCYnvsUqN1Y

For the 1-1 reconciliation matching type of payments and receipts, the reconciliation differences amount can be automatically split into the exchange gain or loss and bank charges accounts defined at business unit access level for the bank account..

For all the other reconciliation matching type scenarios (1-M, M-1, M-M), and transaction sources, such as payroll, external transactions or journals, the reconciliation differences account defined at bank account setup is used.

- Bank Statement: The bank statement transaction creation program creates transactions based on rule you define from unreconciled statement lines. This includes items such as bank charges, interest, or other miscellaneous items.

The bank statement reconciliation involves reconciling the statement lines with the source transactions. The bank statement line amount can differ from the source transaction amount due to the following reasons:

- Charges: The transaction processing involves charges. The charges can be processing fee, transaction fee, commission,discounting, or collection charges. These charges are part of the statement line mount.

- Currency exchange differences: This occurs for foreign currency transactions where the conversion rate is different from the date the transaction was created and cleared in bank, due to fluctuations in the conversion rate.

During the reconciliation, Tolerance rules are defined to identify the amount difference between statement line and system transactions. Any amount difference within the amount tolerance is automatically created as an external transaction, with the origin: Reconciliation Difference.

when tolerance amounts are applied, the reconciliation differences generated during 1-1 matching of Payment/Receipt reconciliation,can now be created for specific foreign exchange gain/loss and bank charges accounts.

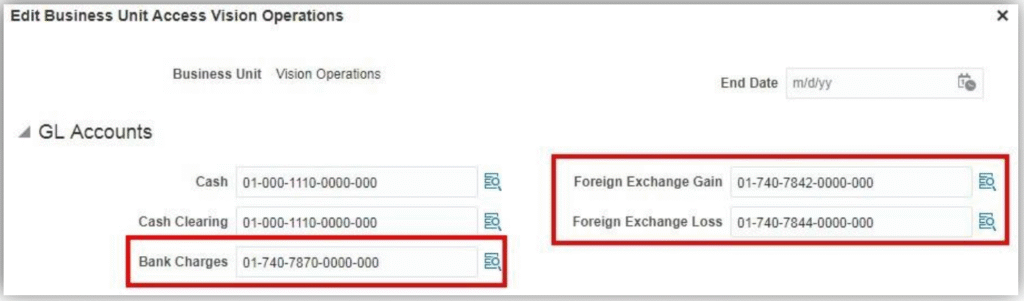

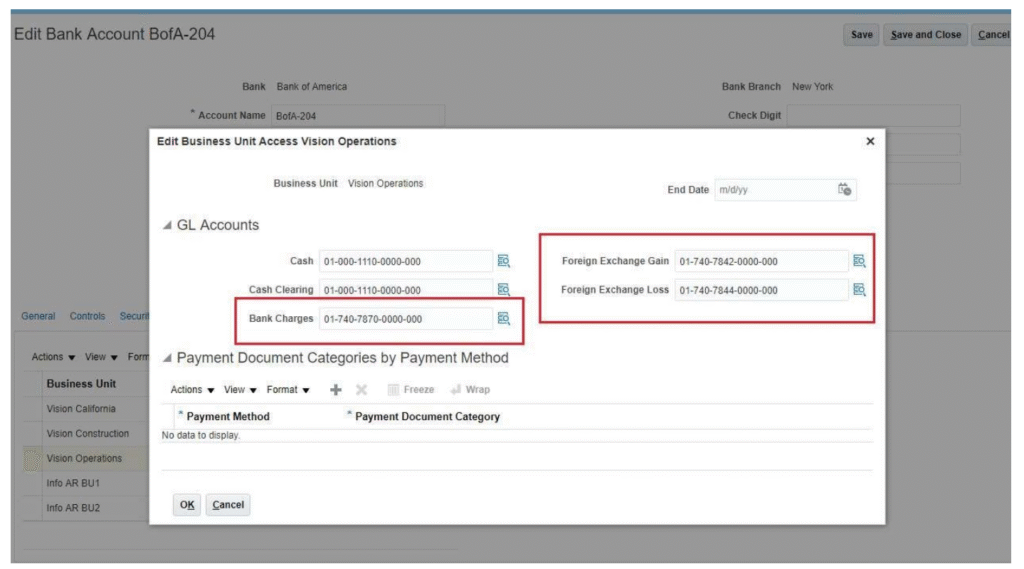

The foreign Exchange Gain, Foreign Exchange Loss, and Bank Charges accounts are defined at Bank Account – Business Unit access level:

Business Rules -External transactions and bank transfer

- The foreign exchange gain/loss or bank charge accounts will be used only for 1-1 matching of ayments and receipts. For foreign exchange gain/loss – If the foreign exchange gain/loss account is setup for the payment/receipt business unit, then this account will be defaulted. Else, the reconciliation difference account will be used to create the external transaction.

For Bank charges/Forex charges – If the bank charges account is setup for the payment/receipt business unit, then this account will be defaulted, else the reconciliation difference account will be used to create the external transaction. - For all other matching scenarios (1-M, M-1, M-M) and reconciliation of other source transactions (payroll/external transactions),the reconciliation difference account will be used to create the external transaction:

External transactions and bank transfer

The system will always check for the validity of the account code combinations before creating the external transactions

Domestic currency bank account – Multi-currency disabled

For domestic bank accounts, non-multicurrency account (transaction currency = bank account currency = ledger currency):

- Any amount difference (under the tolerance rule) between the bank statement line amount and the transaction amount are bank charges.

- Domestic currency bank account – Multi-currency enabled

The original currency, amount, and exchange rate will generate the Cleared amount, and it will be compared with the bank statement line amount, and transaction amount, resulting in:

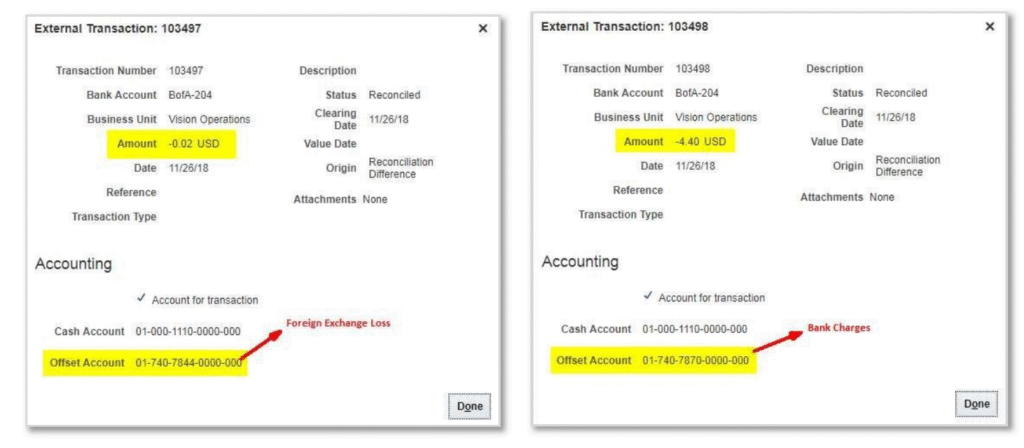

- Foreign Bank Charges – The difference between the cleared amount in base currency (original currency amount *exchange rate) and the bank statement line amount will be treated as bank charges. An xternal transaction will becreated using the bank charges account.

- Exchange difference – The difference between the cleared amount in base currency (original currency amount *exchange rate) and the payment/receipt amount will be treated as foreign exchange difference. An external transaction will be created using the foreign exchange gain/loss account.

To overwrite the conversion rate when you create the external transaction

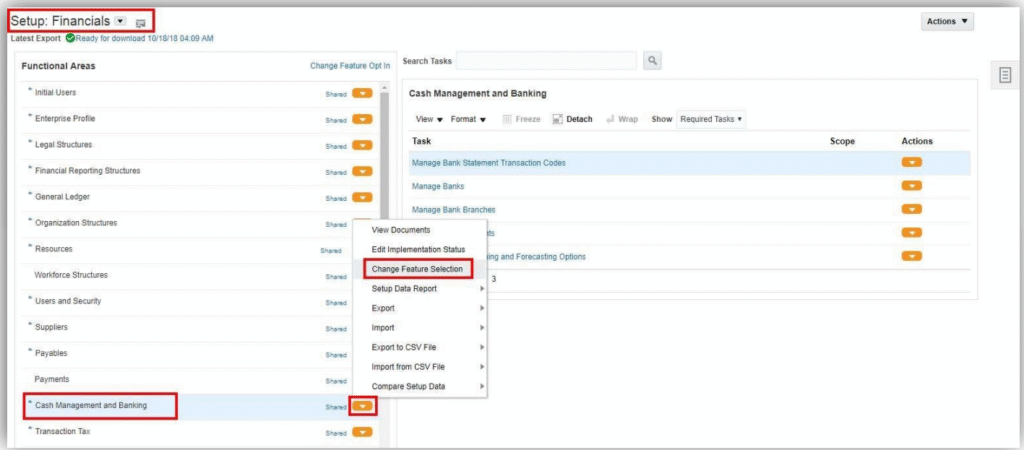

STEPS TO ENABLE THIS FEATURE-External transactions and bank transfer

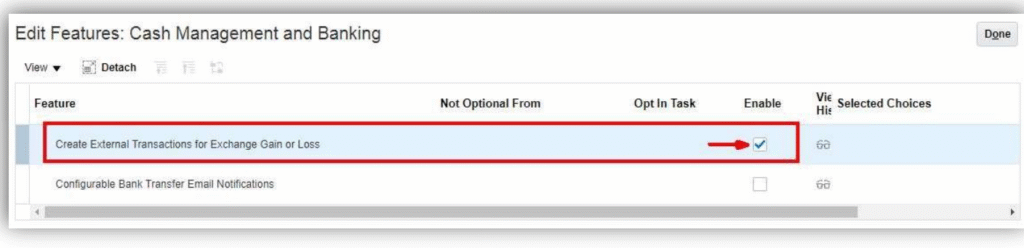

Opt-in the Create External Transactions for Exchange Gain or Loss feature

. Go to the Setup and Maintenance and select – Financials> Cash Management and Banking > Change Feature Selection

Click on the Enable checkbox for Create External Transactions for Exchange Gain or Loss feature

Setup Foreign Exchange Gain, Foreign Exchange Loss, and Bank Charges accounts at Bank Account setup.

Go to Manage Bank Accounts tasks.

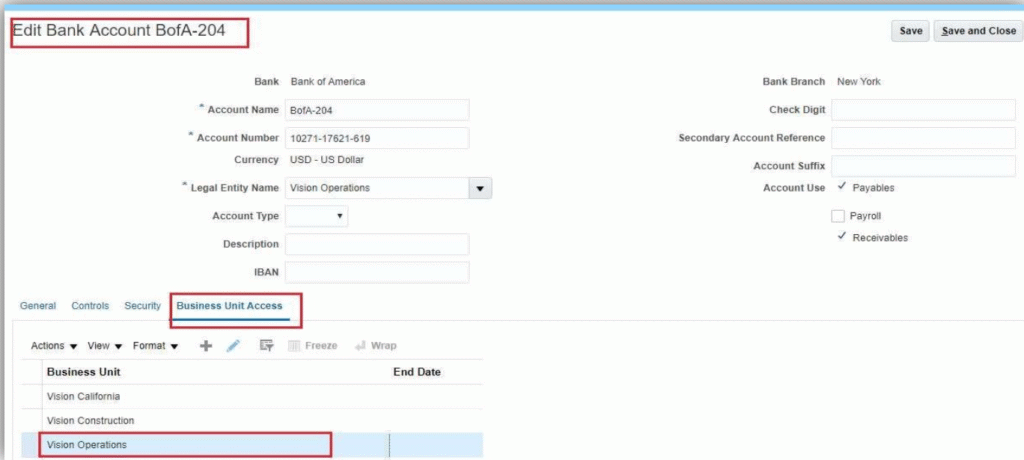

2.2. Edit your Bank Account, and go to the Business Unit Access tab:

Define the Foreign Exchange Gain, Foreign Exchange Loss and Bank Charges accounts for each Business Unit:

WORKED EXAMPLE – MULTICURRENCY ACCOUNT

External transactions and bank transfer

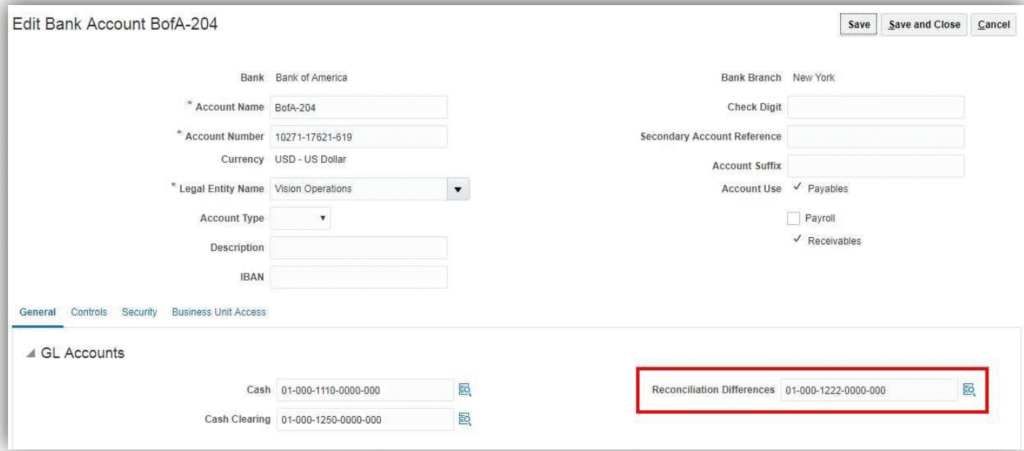

Review Setup for BofA-204 bank account:

✓ Multicurrency enabled

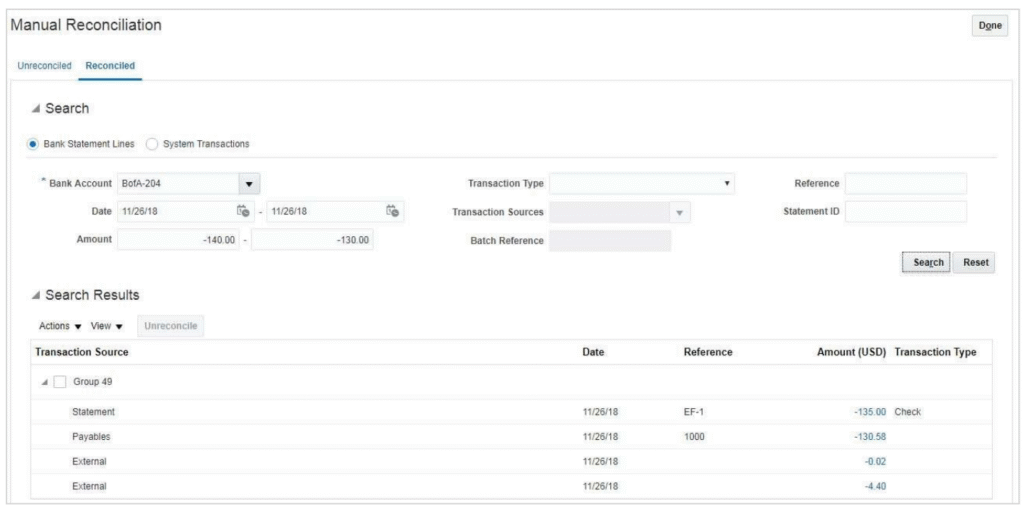

✓ Reconciliation Differences: 01-000-1222-0000-000

✓ Bank Charges for Vision Operations: 01-740-7870-0000-000

✓ Foreign Exchange Gain: 01-740-7842-0000-000

✓ Foreign Exchange Loss: 01-740-7844-0000-000

- Review Tolerance Rule for BofA-204 bank account:

Amount Tolerance: Enabled

- Amount Below: 200

- Amount Above: 200

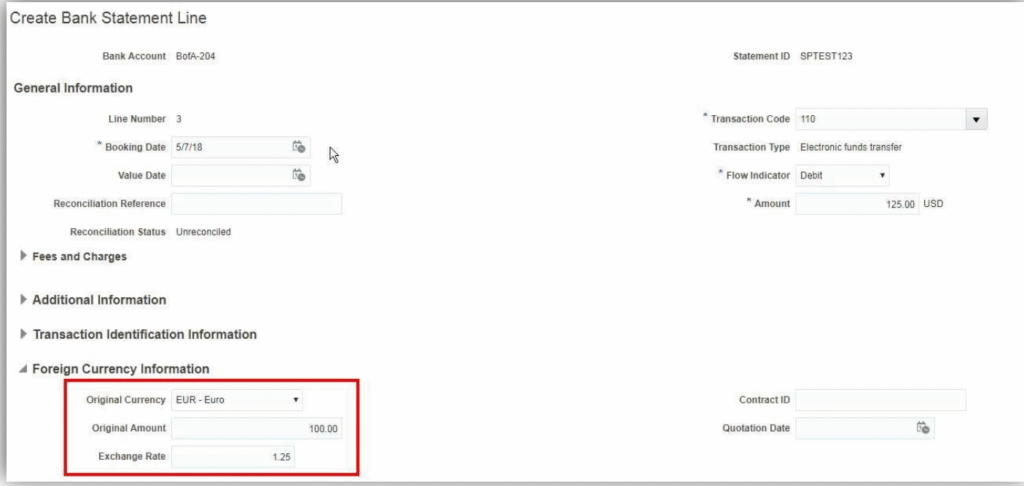

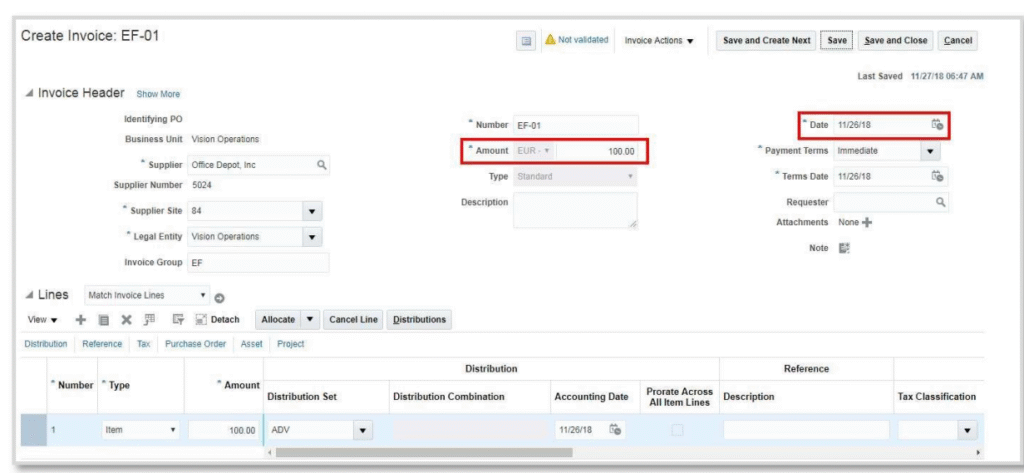

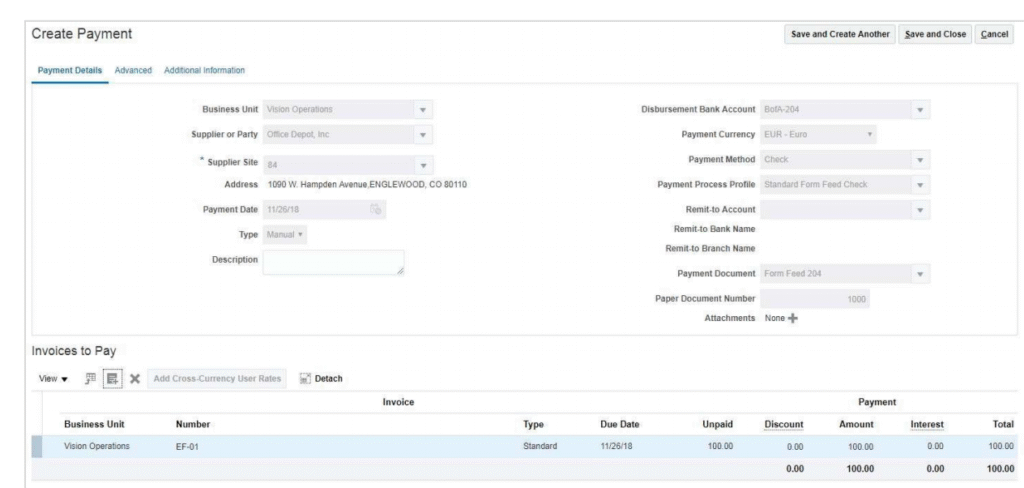

- Create an Invoice for BofA-204 of EUR 100.00:

Create a payment for this invoice

BANK CHARGES X EXCHANGE GAIN/LOSS

Bank Charges – The difference between the cleared amount in base currency (bank statement line original currency amount *exchange rate) and the bank statement line amount will be treated as bank charges.

✓ Exchange Difference – The difference between the cleared amount in base currency (bank statement line original currency amount *exchange rate) and the payment/receipt amount will be treated as foreign exchange difference. An external transaction will be created

using the foreign exchange gain/loss account.

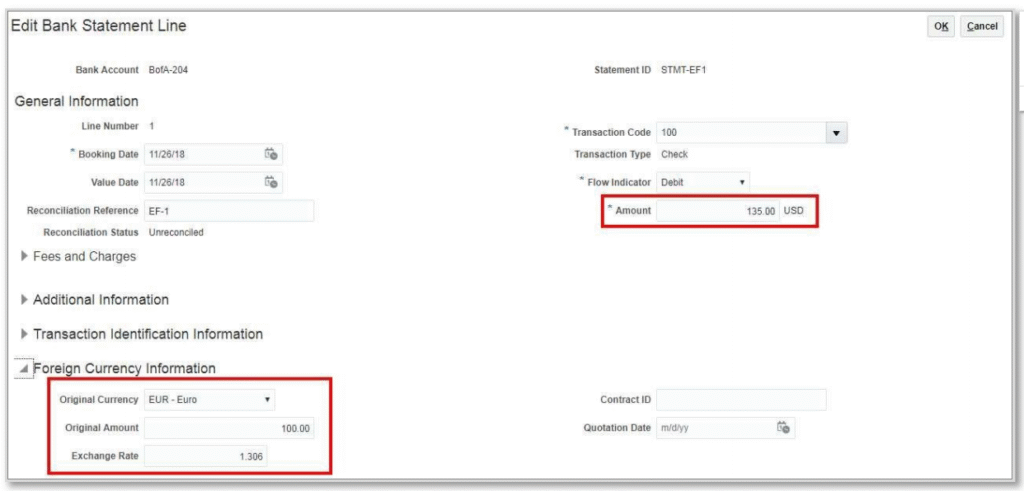

- Bank Statement Line Information (Line Amount, Original Amount, and Exchange Rate)

- Original Amount = 100.00 EUR

- Exchange Rate = 1.306

- Cleared Amount = 100.00 * 1.306 = 130.60 USD

- Bank Statement Line Amount = 135.00 USD

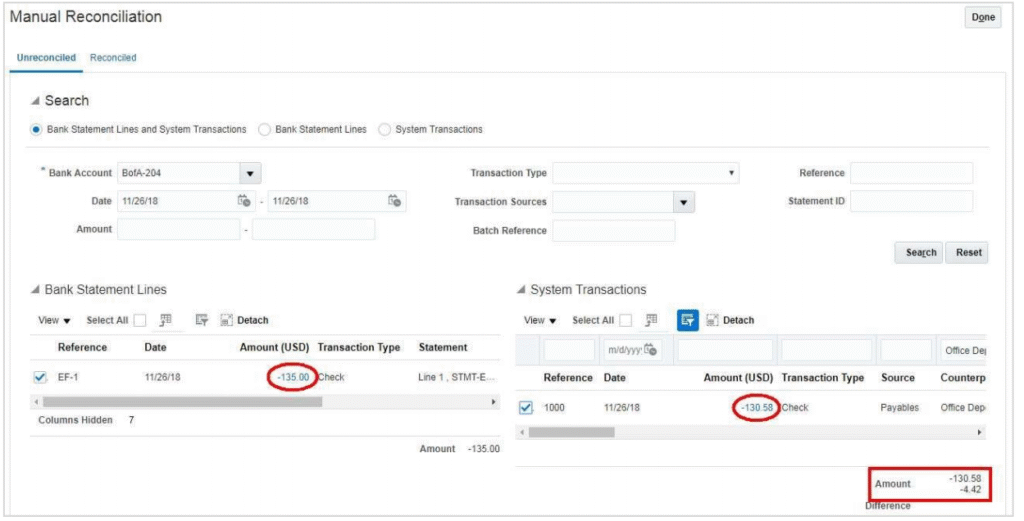

Manual Reconciliation

Cleared Amount = Bank Statement Line Original amount * Exchange Rate

Cleared Amount = 100.00 *1.306 = 130.60

- Bank Charges = Cleared Amount – Bank Statement Line Amount = 130.60 – 135.00 = -4.40

- Exchange Gain/Loss = Cleared Amount – Payment/Receipt Amount = 130.60 – 130.58 = 0.02

Results after Reconciliation:

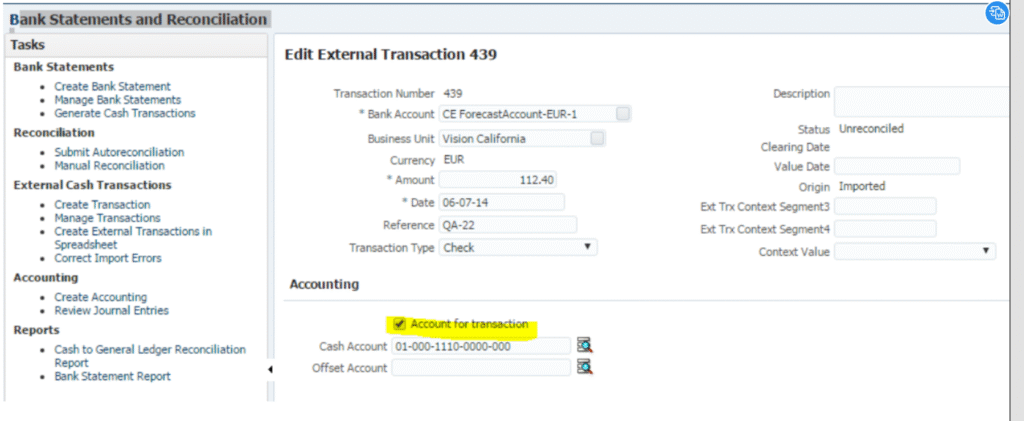

No Accounting Created for Reconciled External Cash Transactions, even after

running create accounting in cash management module.??

Account for transaction unchecked.

- Navigate to Bank Statements and Reconciliation –> Manage Transactions

- Search for your transaction

- Open the transaction and click on Edit tab

- In the Accounting section, there is a checkbox named: Account for transaction.

Check this checkbox

1.Is It Possible To Mass Void External Transactions?

2.Is It Possible to Mass Void External Transactions?

3.Is there any way to mass void external transactions?

Note: External Transactions can only be voided, but cannot be purged.

There is no functionality via Spreadsheet to void the loaded external transactions, but however, you can follow the below action plan to void the multiple external transaction at once

Please go to Manage External Transactions

- Search the problematic records based on bank account or other criteria which matches your requirements

- Select multiple records

- Go to actions > click on ‘Void’

This will void the selected transactions

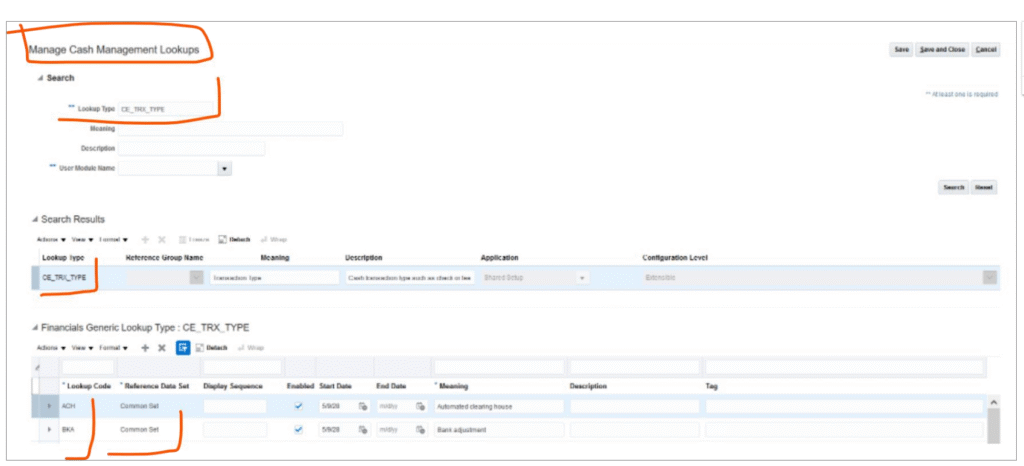

How can a user create custom transaction types to manage external transactions in Fusion Cash Management?

To create your own transaction type you need to do the following:

Go to Setup and Maintenance.

Pick the task ‘Manage Cash Management Lookups’.

Click on to ‘Go to Task’ for the above.

Now select the code ‘CE_TRX_TYPE’

Now create your own transaction type code and save.