Tax Formula Overview

Tax formula is used in the tax calculation process. They help to determine the taxable basis of a

transaction line and the calculation methodology that must be applied to obtain the tax amount.

When the parameters available on a transaction do not satisfy the rule conditions, the default tax

formulas defined for the tax are applicable.

There are two types of tax formulas:

- Taxable basis tax formula

- Tax calculation tax formula

Click here to get Oracle Fusion Instance access for Practice

Taxable Basis Tax Formula

The taxable basis tax formula is used in the tax calculation process. They help to determine the

amount or quantity that should be considered as the taxable basis of a transaction line. The tax rate

is applied on the taxable basis amount to derive the basic tax amount on a transaction line.

The taxable basis type, defined in the taxable basis formula, decides the characteristics of the

taxable basis amount.

The various taxable basis types are:

- Line amount

- Assessable value

- Prior tax

- Quantity

The following standard predefined taxable basis tax formulas are available: - STANDARD_QUANTITY

- STANDARD_TB

- STANDARD_TB_DISCOUNT

Line amount

Use line amount when the transaction line amount is to be treated as the taxable basis to

calculate tax.

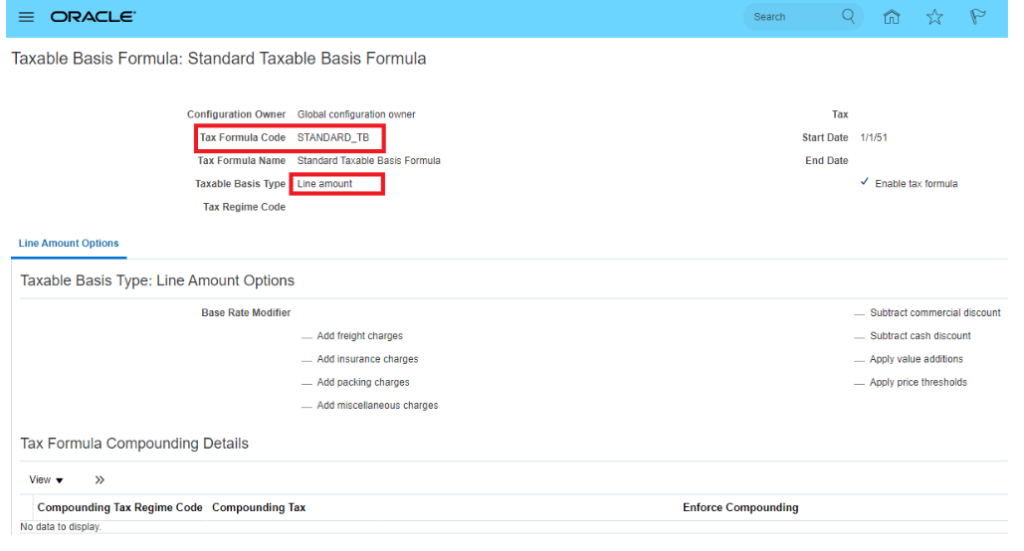

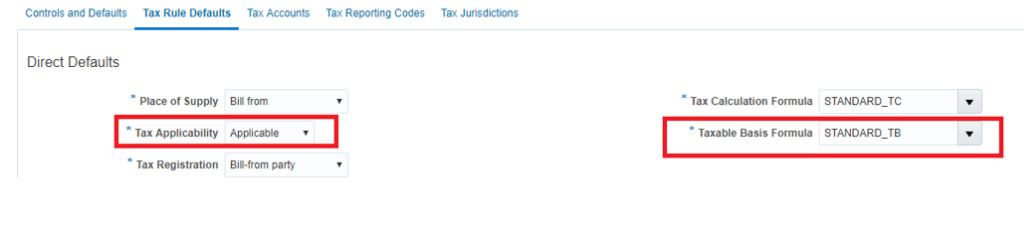

By Default, Taxable Basis is Line Amount (STANDARD_TB) in tax setup

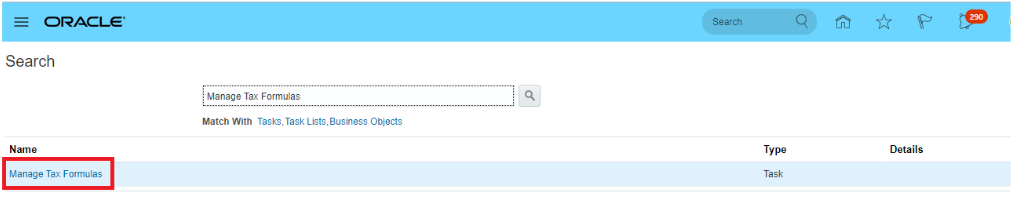

Step 1: Search “Manage Tax Formulas” task

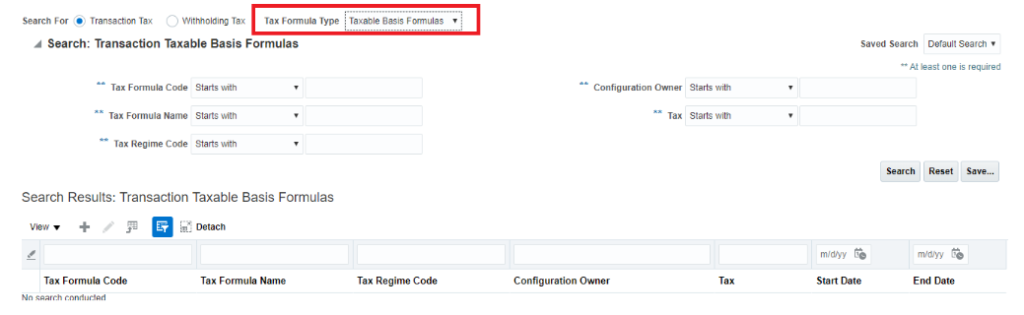

Step 2: Select the Tax Formula Type

Step-3 Search the Tax Formula Code

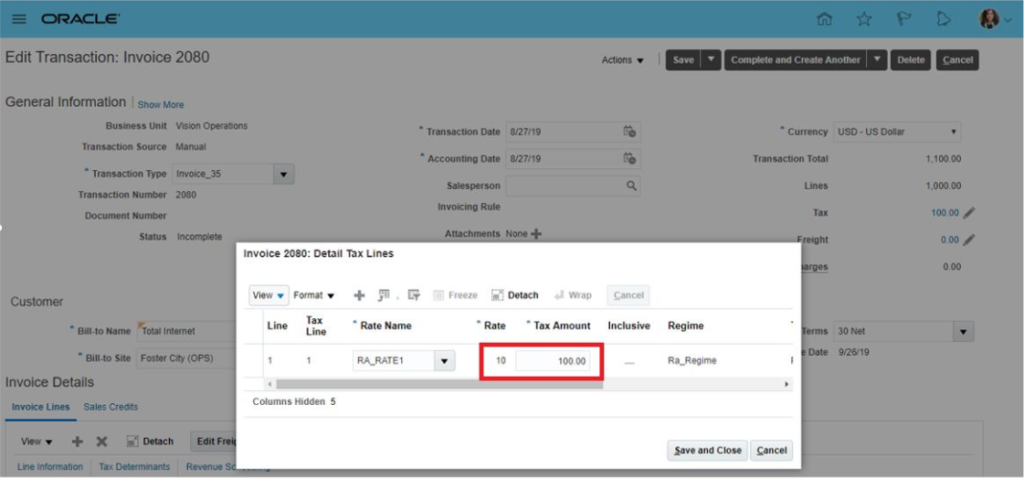

Scenario: STANDARD_TB

Taxable Basis is Line Amount (STANDARD_TB)

Example:

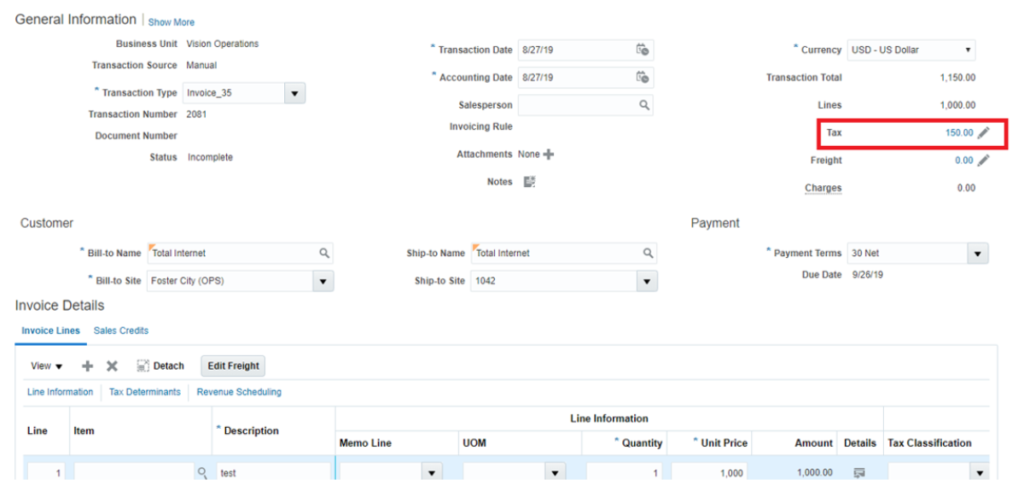

Line Amount = 1000

A-Tax Calculation = Taxable Basis *Rate%

B-Tax Calculation = Line Amount *10%

C-Tax = 1000 *10%

D-Tax =100

Base Rate Modifier

The transaction line amount is increased or decreased based on the percentage value given.

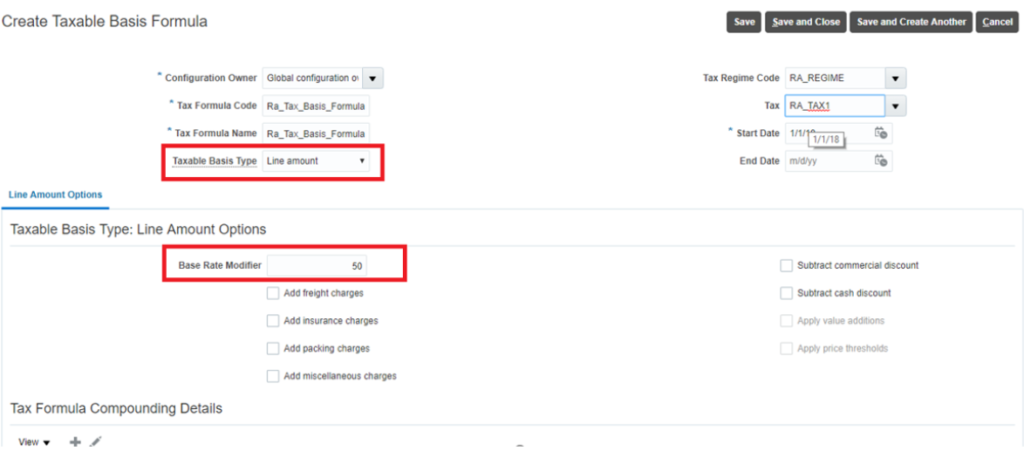

Scenario 1: Taxable Basis = Line Amount + Base Rate Modifier

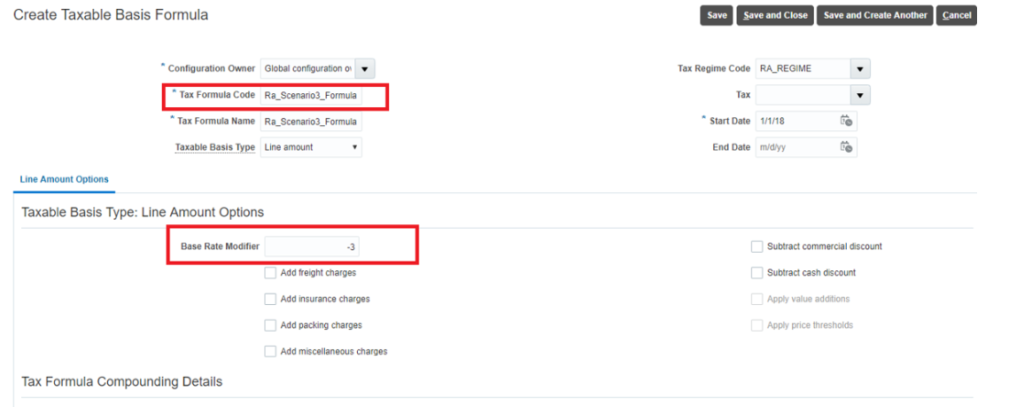

Step 1: Creating Taxable Basis Formula:

Navigation: Manage Tax Formulas →Create Taxable Basis Formula

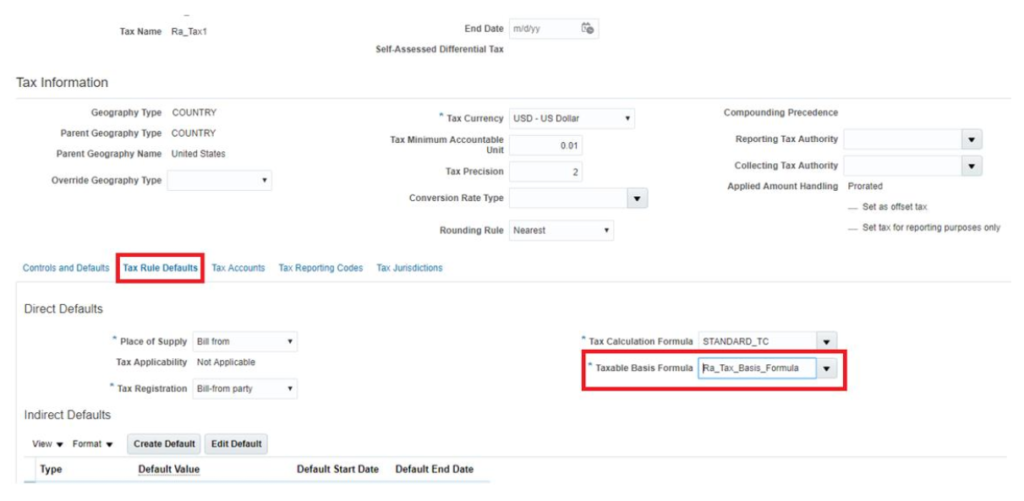

Step 2-Assign the user defined taxable basis formula in the tax setup.

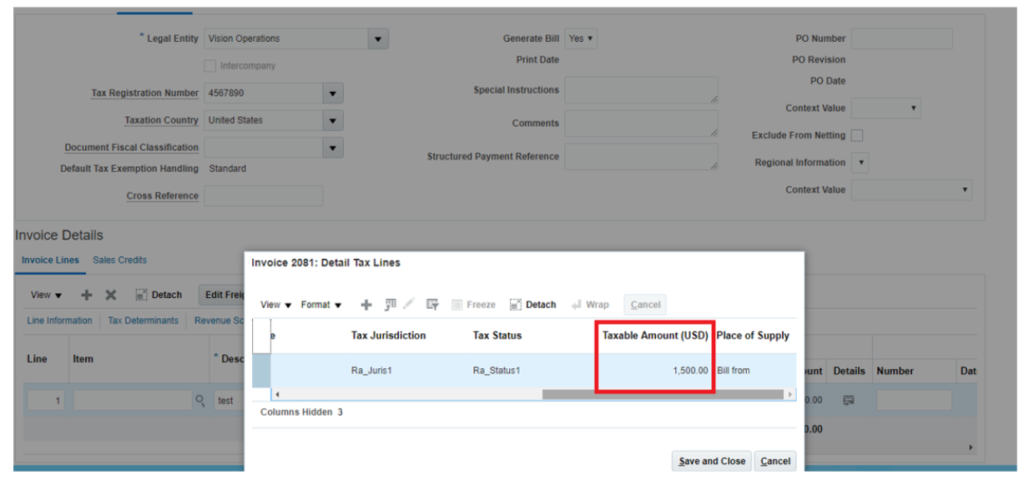

Example:

Line Amount = 1000

Base Rate Modifier = 50% of line amount = 500

Taxable Amount = Line Amount + Base Rate Modifier

= 1000 + 500

= 1500

Tax Calculation = Taxable Amount * Rate%

= 1500*10%

Tax = 150

Step 3: Create transaction and check the taxable amount

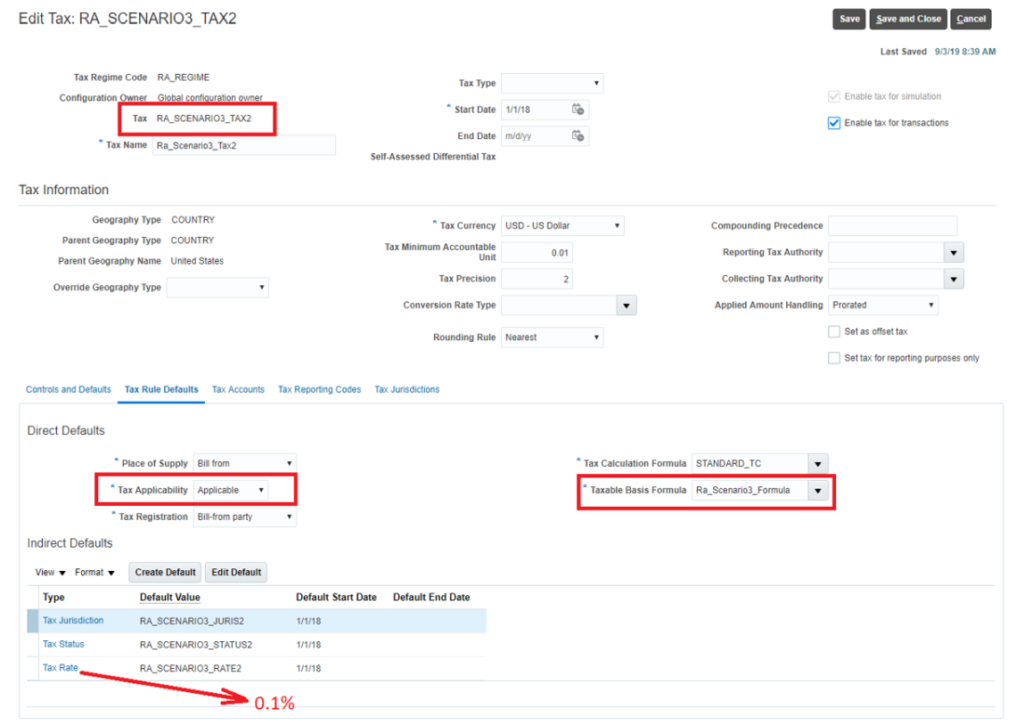

Scenario 2: Taxable Basis = Line Amount – Base Rate Modifier

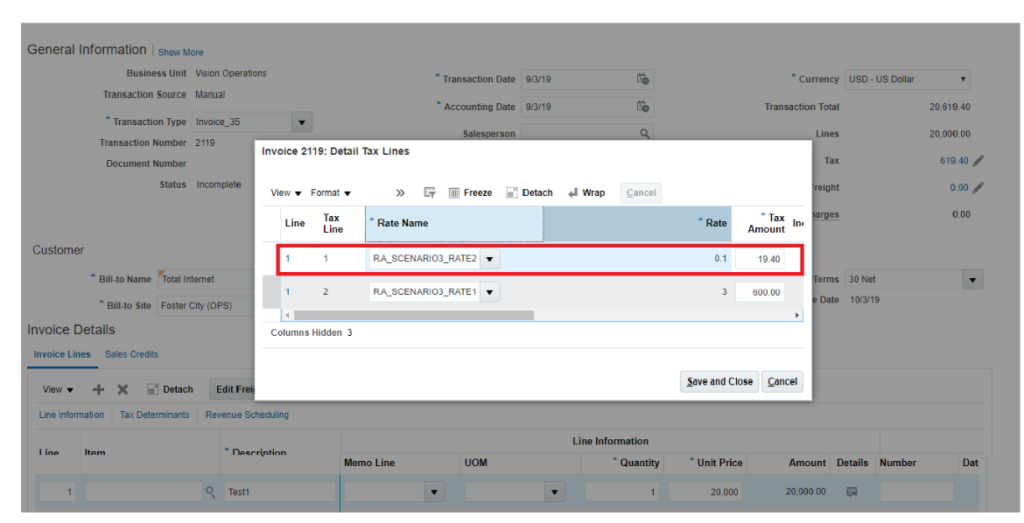

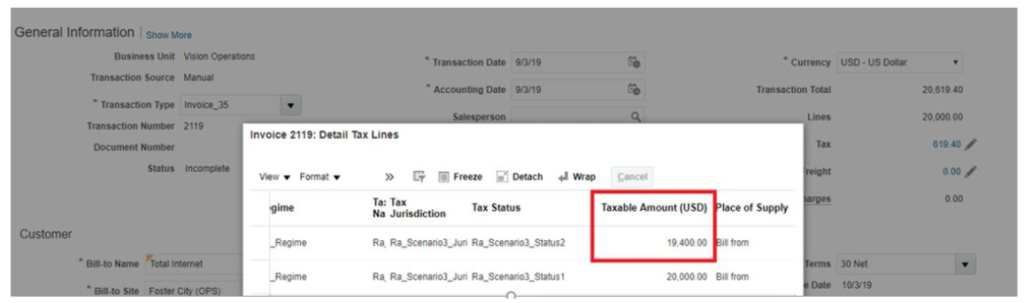

Another example of Base Rate Modifier: Calculate two taxes on a transaction.

Tax1 should be 3% of line amount and Tax2 should be (Line Amount – Tax1) X 0.1%

Example:

Line amount = 20000

Tax1 = 200003% Tax1 = 600 Taxable amount for Tax2 is (Line Amount –Tax1) i.e. 20000-600= 19400 Tax2 = 194000.1% = 19.4

1: Create Tax1 and select STANDARD_TB as taxable basis formula

2: Create Taxable Basis Formula for Tax2.

3: Create Tax2 and select above custom taxable basis formula.

4: Create a transaction and check the taxable amount for Tax2

Line amount = 20000

Tax1 = 200003% Tax1 = 600 Taxable amount for Tax2 is (Line Amount –Tax1) i.e. 20000-600= 19400 Tax2 = 194000.1% = 19.4

In Next session we will discuss Tax formula compounding

Click here to watch how to create tax rule for reduced rate in Oracle Fusion